Leave Management for Insurance

Insurance company leave management - maintain claims processing, ensure regulatory compliance, and support customer service operations.

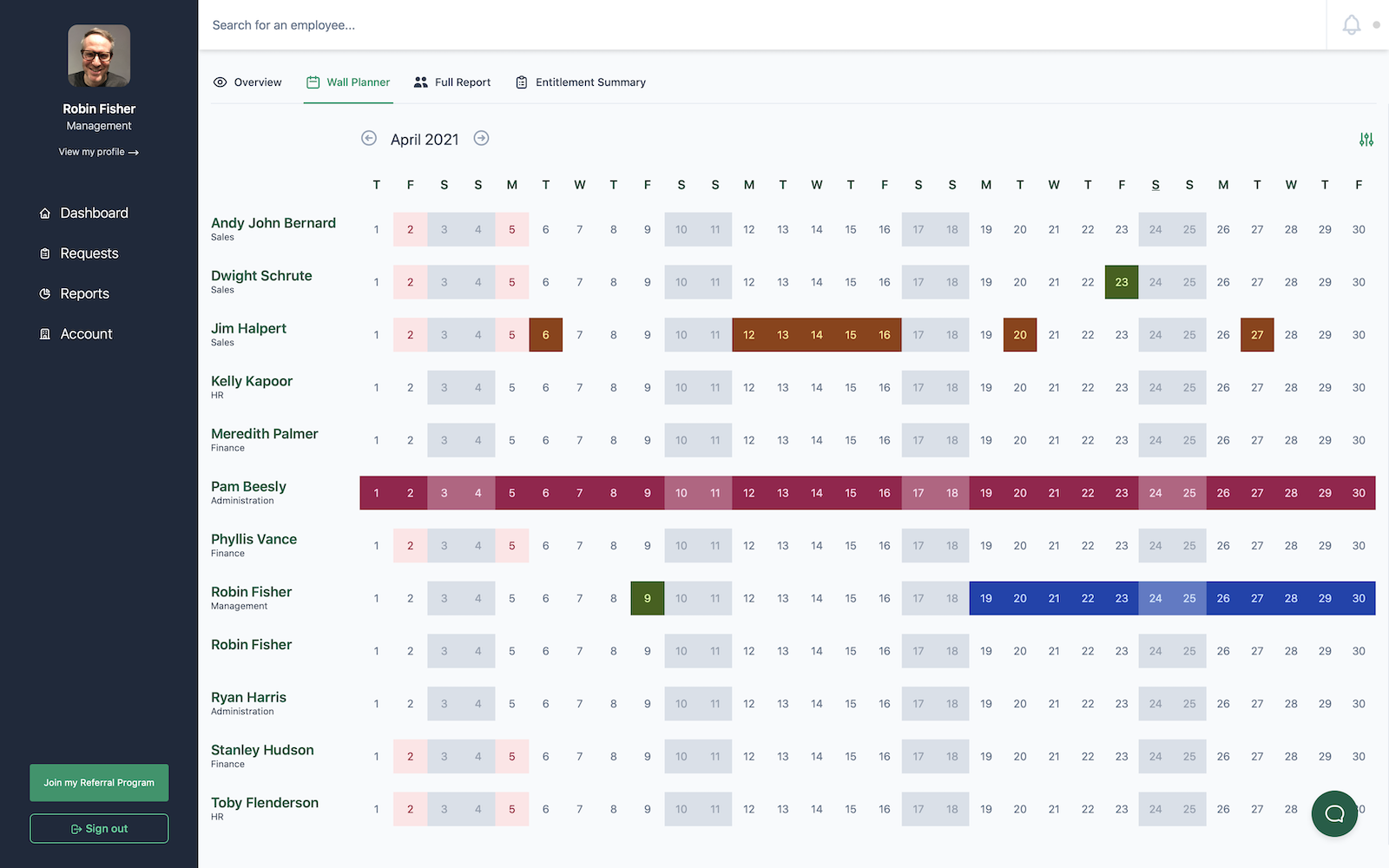

Insurance companies require reliable leave management that ensures claims processing continuity and regulatory compliance. Leavetrack helps insurance organizations manage absences while maintaining customer service standards and operational efficiency.

Insurance Challenges

Insurance Industry Challenges

Insurance operations require consistent service delivery

-

Claims Processing Continuity

- Delays in claims processing due to absences can impact customer satisfaction and regulatory compliance timelines.

-

Customer Service Standards

- Insurance customers expect consistent service quality

-

Regulatory Reporting Requirements

- Insurance companies must maintain specific response times and service levels to meet regulatory obligations.

Solutions for Insurance

Insurance-Optimized Solutions

Leavetrack supports insurance operational requirements

-

Claims Team Coverage

- Specialized coverage workflows that prioritize claims processing teams and maintain service level agreements.

-

Customer Service Continuity

- Automated coverage suggestions that ensure consistent customer service quality during staff absences.

-

Compliance Timeline Protection

- Built-in monitoring of regulatory timelines with proactive coverage planning for compliance-critical roles.

Why Insurance Choose Leavetrack

Insurance companies using Leavetrack maintain 98% SLA compliance and improve customer satisfaction scores. The platform's insurance-specific features ensure operational continuity while meeting regulatory requirements.

- 98% SLA compliance maintained

- Improved customer satisfaction

- Enhanced claims processing

- Streamlined regulatory reporting

Ready to Transform Your Leave Management?

Start Your Free Trial Today

Join hundreds of insurance organizations already using Leavetrack to streamline their absence management.