Leave Management for Banking

Bank leave management - maintain branch operations, ensure regulatory compliance, and provide customer service continuity.

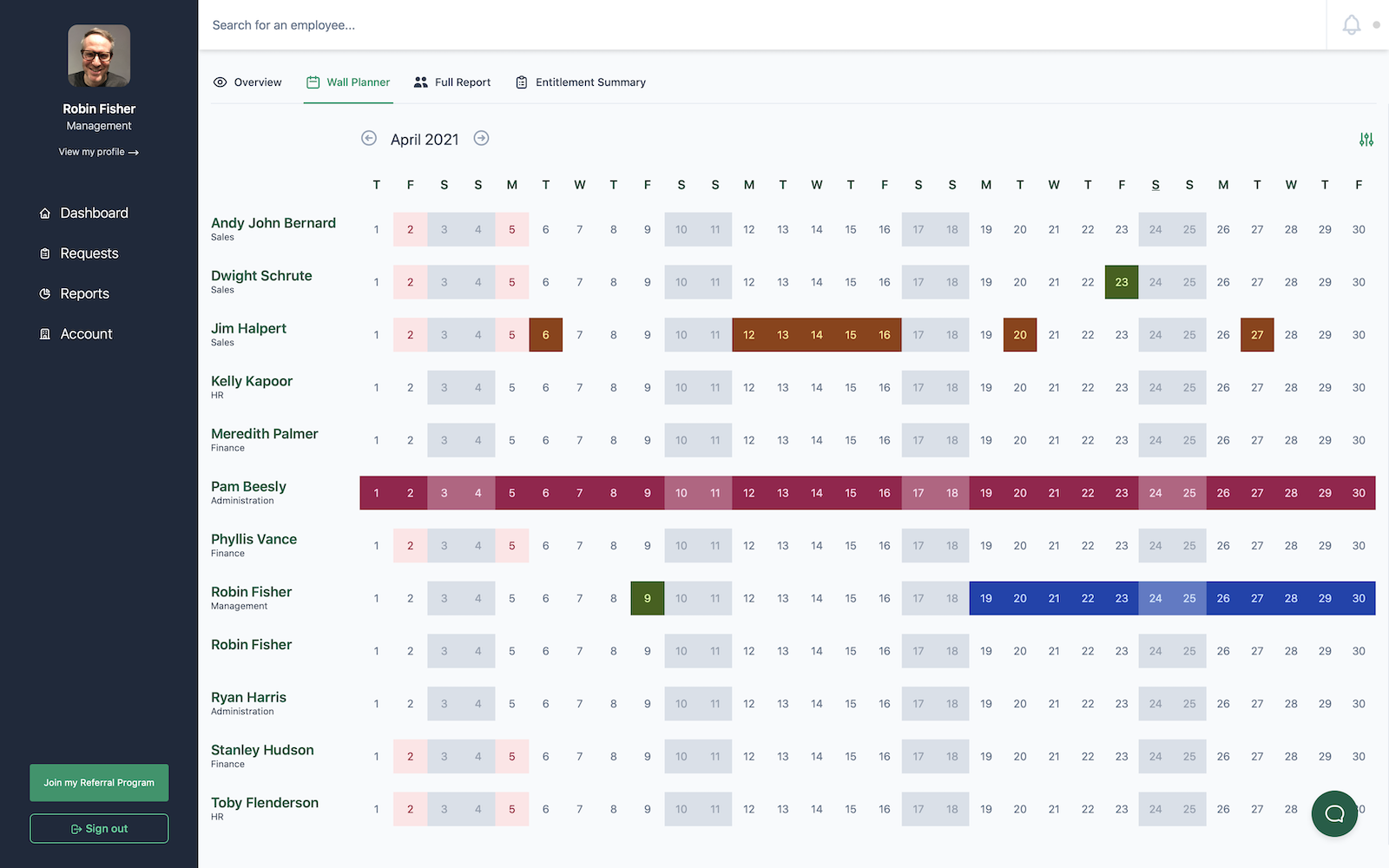

Banking institutions require comprehensive leave management that ensures customer service continuity and regulatory compliance. Leavetrack helps banks and credit unions manage employee absences while maintaining service standards and meeting financial regulations.

Banking Challenges

Banking Industry Challenges

Financial institutions face customer service and compliance requirements

-

Branch Operation Continuity

- Bank branches must maintain adequate staffing levels to serve customers and process financial transactions efficiently.

-

Regulatory Compliance Requirements

- Banking operations must comply with financial regulations that require specific staffing and oversight standards.

-

Customer Service Standards

- Bank customers expect consistent service quality

Solutions for Banking

Customer-Focused Banking Solutions

Leavetrack optimizes banking workforce management

-

Branch Staffing Optimization

- Intelligent coverage planning that ensures adequate branch staffing for customer service and transaction processing.

-

Compliance Monitoring Integration

- Built-in tracking of regulatory requirements with automated alerts for compliance-critical staffing levels.

-

Service Quality Continuity

- Automated coverage workflows that maintain customer service standards and minimize service disruptions.

Why Banking Choose Leavetrack

Banking institutions using Leavetrack maintain 98% customer service standards and achieve full regulatory compliance. The platform's banking-specific features ensure service quality while meeting financial industry requirements.

- 98% customer service standard compliance

- Full regulatory compliance achieved

- Enhanced branch operations

- Improved customer satisfaction

Ready to Transform Your Leave Management?

Start Your Free Trial Today

Join hundreds of banking organizations already using Leavetrack to streamline their absence management.